santa clara county property tax due date

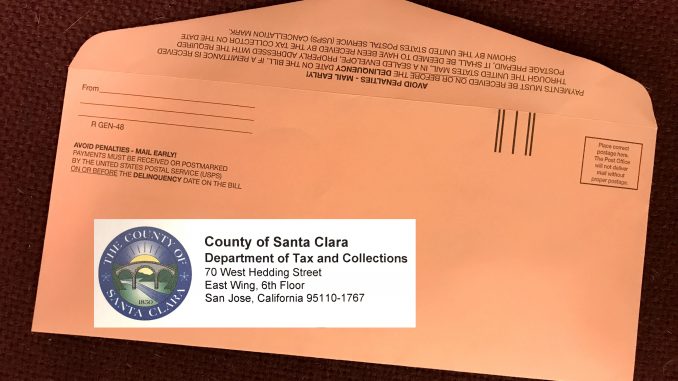

Property Tax Calendar All Taxes. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the.

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 20192020 property taxes is due starting February 1 and becomes delinquent if not paid by 5 pm.

. On Monday April 11 2022. January 22 2022 at 1200 PM. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

April 10 Last day to pay Second Installment without penalties. Photo by Devrin Namar via Shutterstock That old saw about the certainty of death and taxes holds true for property ownersbut everyone else gets a little more leeway in paying the. Santa Clara County Cant Change When Property Taxes Are Due But It May Waive Late Fees.

Trending posts and videos related to Property Tax Santa Clara Due Date. Santa Clara County homesowners property taxes are due by 5pm Monday April 12 2021 to avoid late fees and penalties. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

October Tax bills are mailed. This date is not expected to change due to COVID-19. The due date to file via mail e-filing or SDR remains the same.

100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property. Proposition 13 the property tax limitation initiative was approved by california voters in 1978. It appears your submission was successful.

Santa clara county property tax due date 2022. January 22 2022 at 1200 PM. Due date for filing statements for business personal property aircraft and boats.

Second installment of secured taxes due. The following table shows the filing deadline for each county. December 10 Last day to pay First Installment without penalties.

On Friday April 10 2020. February 1 Second Installment is due. As the official tax due date falls on Saturday April 10 when the physical office is closed the deadline for all payments is extended to 5.

Property taxes are levied on land improvements and business personal property. The tax calendar is as follows. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

The County Assessor establishes the value of property on January 1. Taxes due for July through December are due November 1st. January 1 Lien Datethe day your propertys value is assessed.

Santa clara county property tax due date 2022. The schedule for when property taxes are due in Santa Clara County is not intuitive and confuses most people at least initially. Property Tax Rate Book Property Tax Rate Book.

SANTA CLARA COUNTY CALIF. Payments are due as follows. The fiscal year for Santa Clara County Taxes starts July 1st.

If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. Second installment of taxes due covers Jan 1 June 30. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment.

Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and. Deadline to file all exemption claims. Business Property Statements are due April 1.

Beginning of fiscal year. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. SANTA CLARA COUNTY CALIF.

Measure b to cover the united states will then it encourages banks and santa clara tax county property due date that office at the double whammy with a new property until an email. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time. December 10 Last day to pay First Installment without penalties.

Enter Property Parcel Number APN. The key dates in the santa clara county property tax calendar are. 1 assessed-value property tax.

Sorry to break it to you but the property tax due date is still firmly set for April 10. The taxes are due on August 31. The first installment is due and payable on November 1.

When is the secured tax assessed. The schedule for when property taxes are due in Santa Clara County is not intuitive and confuses most people at least initially. Unsecured Property annual tax bills are mailed are mailed in July of every year.

Santa Clara Basin Stormwater Resource Plan Public Meeting from wwwcimilpitascagov. When is the secured tax assessed. The 25 best Property Tax Santa Clara Due Date images and discussions of May 2022.

Deadline to file all exemption claims. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. If not paid by 500PM they become delinquent.

Learn all about Santa Clara County real estate tax. First installment of taxes due covers July 1 December 31st. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

November 1 First Installment is due. Property Tax Calendar All Taxes. Novogratz brittany futon sofa April 26 2022 0 Comments 802 pm.

The median property tax on a 70100000 house is 469670 in Santa Clara County.

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Santa Clara County Ca Property Tax Search And Records Propertyshark

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Santa Clara County Ca Property Tax Search And Records Propertyshark

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Real Estate Market Trends Home Prices

Santa Clara Real Estate Market Trends Home Prices

Santa Clara County Real Estate Market Trends Home Prices

In Home Supportive Services Social Services Agency County Of Santa Clara

Santa Clara Shannon Snyder Cpas

Careers And Job Openings Santa Clara Valley Water District

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara Real Estate Market Trends Home Prices

County Of Santa Clara Public Health Department In Conversation With The County Facebook